Financing that lets you focus on patients, not paperwork.

Running a medical practice or pharmacy means balancing patient care with the costs of growth, staffing, and technology. IOU Financial helps physicians access fast, flexible funding with consultative term loans and other funding solutions built to keep practices thriving.

Find the funding that fits your medical practice.

Whether you need ongoing access to working capital or one-time financing for a major investment, IOU Financial has you covered.

Practical funding solutions for modern medical practices and pharmacies.

Whether you are expanding services, managing reimbursement cycles, or preparing for your next phase of growth, IOU Financial gives your practice the flexibility to put funds where they make the biggest impact.

Expansion

Equipment

Inventory

Marketing and advertising

Technology upgrades

Working capital

Who qualifies for an IOU business term loan?

Getting funding should not feel out of reach. If you run a practice with steady revenue and at least a year in operation, you could be a great fit.

1 year in business or more

We support practices that have established operations and understand their patient base.

$10,000 or more in monthly revenue

A clear picture of monthly income helps us structure a loan that fits your practice comfortably.

A personal credit score of 630 or higher

We work with healthcare owners across a wide range of credit backgrounds.

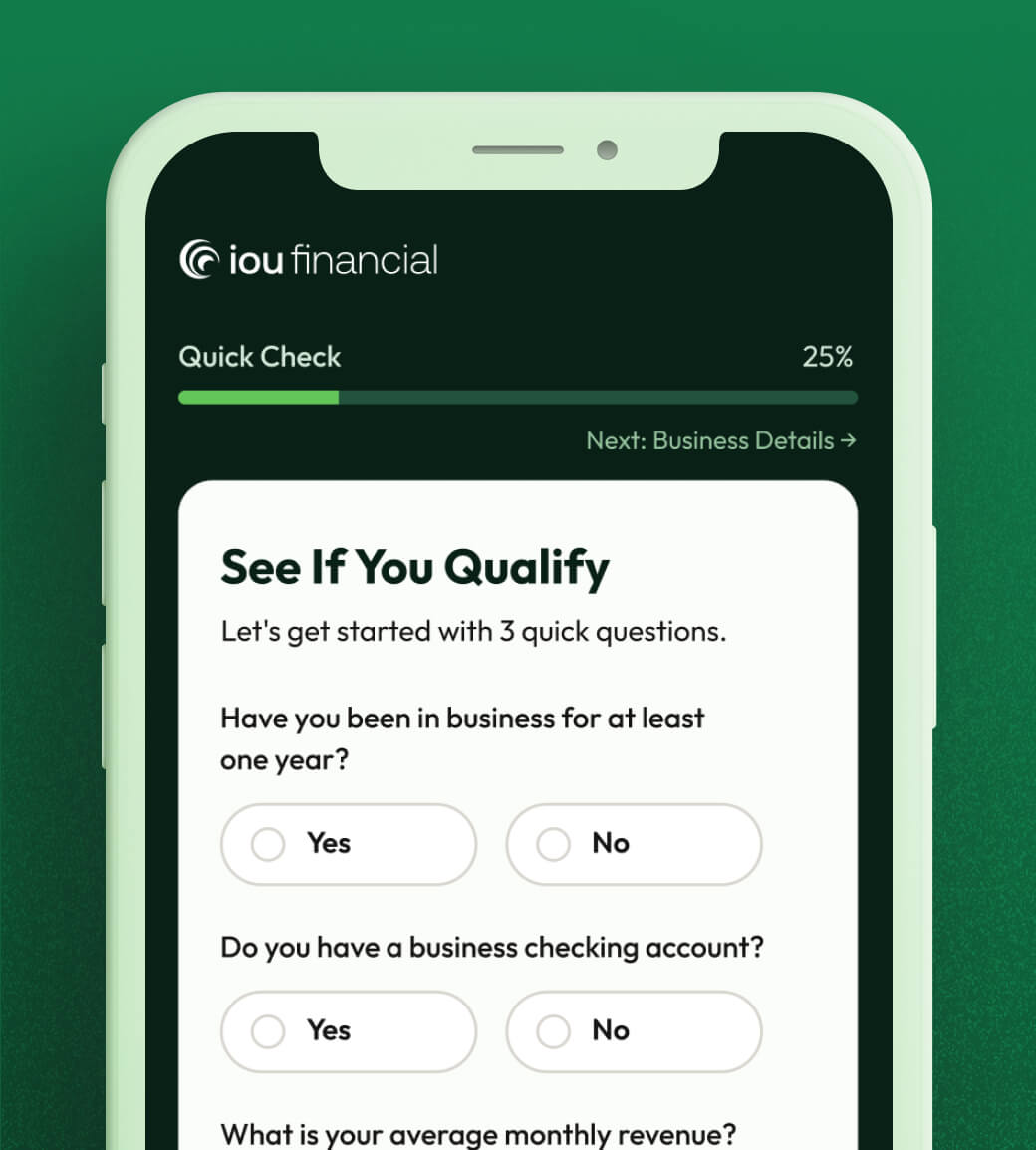

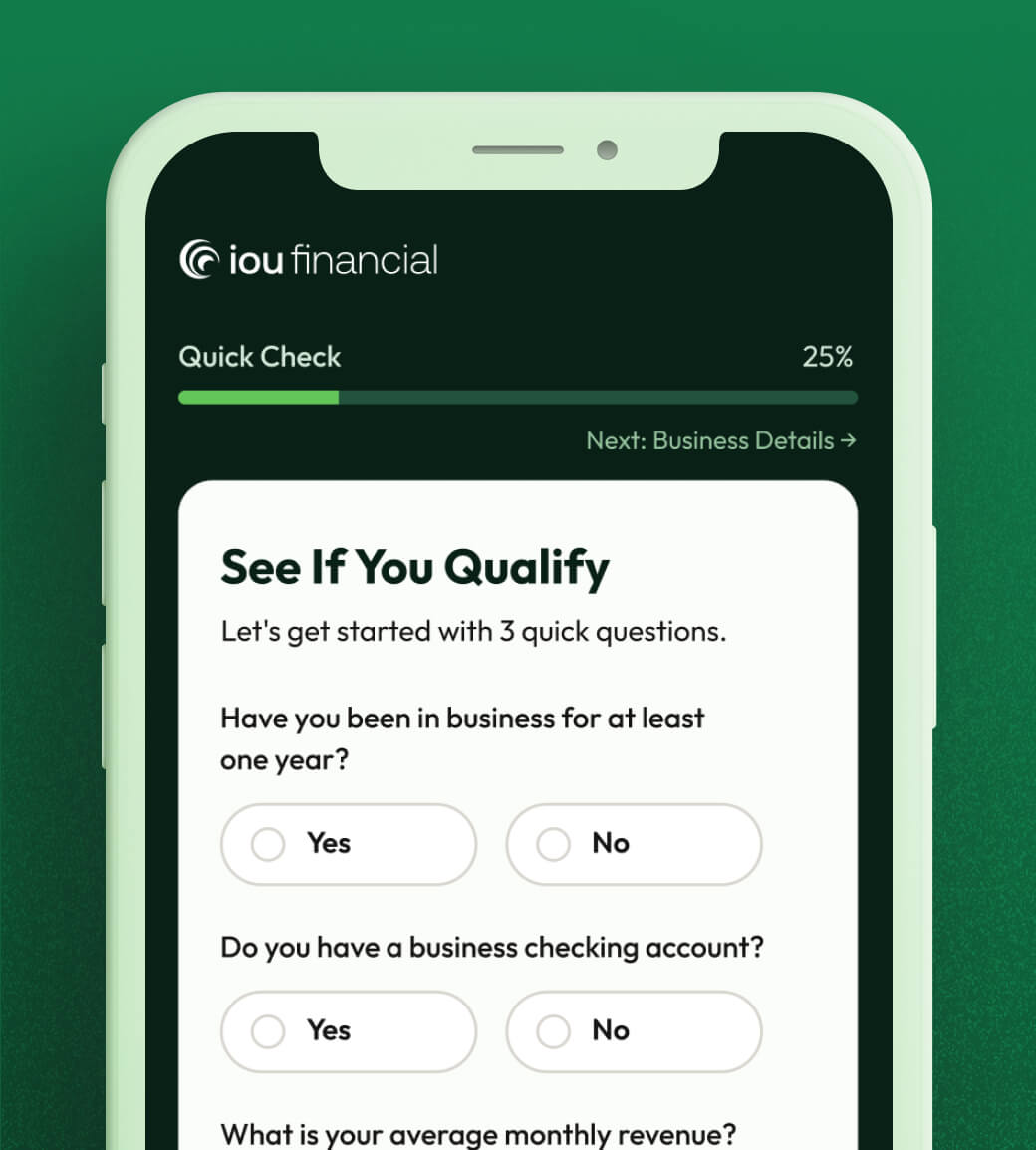

Secure your medical practice funding in 3 simple steps.

Accessing capital shouldn’t be complicated. IOU Financial makes it easy for medical practice and pharmacy owners to get the working capital they need—without slowing down operations. Our quick, guided process helps you move from application to approval in just a few days.

-

Start by sharing a few details about your business and how you plan to use your funds. It only takes a few minutes to complete our simple online application.

Ready to accelerate your business?

Start your financing journey with a simple, transparent application process. We succeed when your business succeeds, which is why doing right by small business owners will always come first.